The Small Business Administration (SBA) created the Paycheck Protection Program (PPP) to help casinos navigate through the coronavirus pandemic. The casino industry has been hit extremely hard by the coronavirus pandemic, with most casinos being forced to close for a minimum of six weeks.

The program created by the Small Business Administration was a step in the right direction of providing relief, but small casinos have started to figure out that they won’t be seeing any funds.

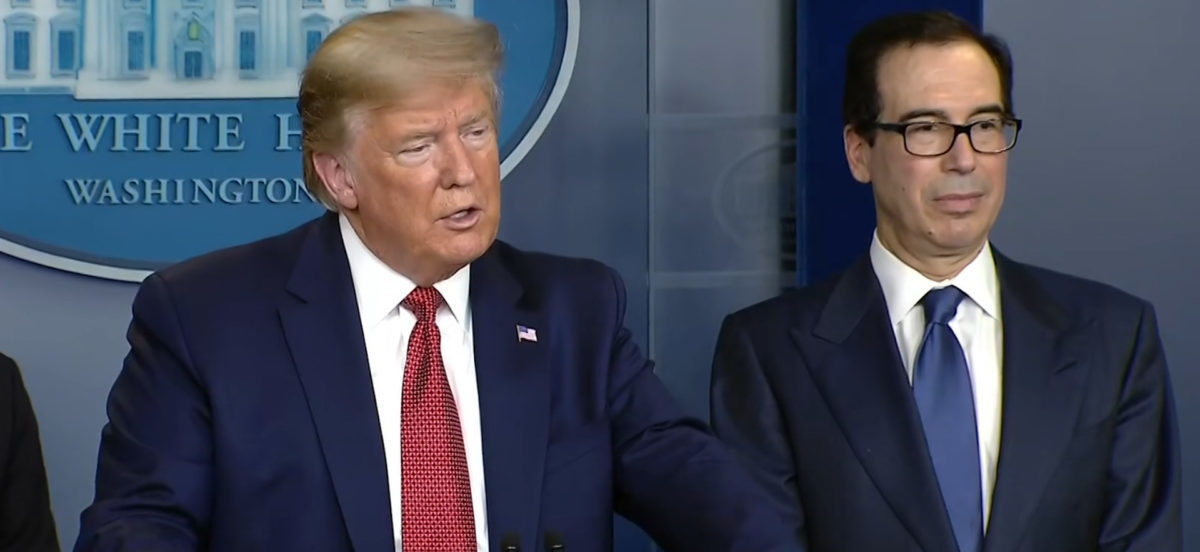

The Paycheck Protection Program was created as a small part of the Coronavirus Aid, Relief, and Economic Security Act (CARES). This emergency relief fund was signed into law by President Donald Trump and was set to provide over $2.2 trillion in relief to companies and businesses throughout the country.

The law was signed on March 27, and small casinos have yet to see any money from the program, and it appears that they will never see any. President Trump and Treasury Secretary Steven Mnuchin have been urged to make some changes to the PPP, and there have been some amendments made.

Mnuchin announced on Tuesday that despite the amendments, small casinos would not be included.

The main reason that small casinos are ineligible to receive any funds is language in the bill that states that businesses cannot generate more than one-third of their revenue from gambling. Seventy-five percent of the funds were set to pay employees during the time of the closure, and loans could be as much as $10 million.

Small casinos make almost all of their money through gambling, and they are unable to apply for these loans.

President Trump has received plenty of opposition about this new program, especially from Las Vegas, and the state of South Dakota. He urged both locations that he would try to get them the relief that they needed, but the Small Business Administration came out with a statement on Tuesday that shut down that possibility for most small casinos.

The Treasury Department now says companies that had gambling revenue exceeding $1 million in 2019 will not be allowed to apply for a loan. They also changed the percentage of gambling revenue to 50% of total revenue to try and include more small casinos.

In Nevada alone, 265 of the 319 gambling locations had a gambling revenue of more than $1 million, making them ineligible to receive the funds. American Gaming Association President Bill Miller continues to fight for the casino industry, noting that all of these locations have complied with state and federal regulations and will remain closed.

The casino industry is set to lose billions of dollars in 2020, and many casinos will be forced to apply for bankruptcy.

No Help For Gambling

The Treasury Department also cited a longstanding belief of the federal government not to give out relief to gambling companies. The American Gaming Association has now focused its attention on the United States Congress to get some new legislation passed.

Simply amending the Paycheck Protection Program will not be an option, and a new relief package will have to be passed.

Nevada Governor Steve Sisolak has ordered that all nonessential businesses be closed through April, which includes all casinos. Other states across the country have done the same thing, with some states extending the closures through mid-May.

Tribal casinos do not have to follow state regulation, but close to 99% of all tribal casinos have shut their doors to stop the spread of the coronavirus pandemic.

Tribal nations are eligible to receive relief found as a part of the $2.2 trillion CARES Act, but only a portion of that money will go to the casino industry.